Welcome to the July edition of the Wealth Awesome newsletter. Thank you to the 17,000+ 🇨🇦 subscribers who join us today!

Market Update

SPONSORED

“Big Plastic” Hates Them

From water bottles to shrink wrap, Timeplast has a $1.3T market opportunity with its patented plastic that dissolves in water. But the clock is ticking to invest. You have until midnight, July 31 to become a Timeplast shareholder as they expand globally.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

Summary

Sentiment Stabilizes: Business Outlook Finds Its Footing Amid Trade Turbulence

Canadian business sentiment appears to have steadied in Q2 2025 following a sharp deterioration in the previous quarter, as outlined in RBC Economics’ latest Forward Guidance.

The Bank of Canada’s upcoming Business Outlook Survey is expected to reflect early signs of improvement in business expectations for sales, hiring, and input prices—particularly as trade tensions eased and Canada was exempted from recent U.S. tariffs.

Supporting data, including steadier job postings and improving confidence in small business surveys, suggest the economy is holding up better than feared. However, resilience in consumer spending continues to underpin stubborn inflation, which, along with potential fiscal stimulus, raises the bar for any further interest rate cuts by the Bank of Canada this year.

Sectors exposed to trade, like manufacturing, may remain cautious, while consumer-facing industries are expected to show more optimism.

⏱ TLDR: After a lot of shock and awe, we seem to be getting back to a new normal.

Key Takeaways 💡

1. 🇨🇦 Business confidence is rebounding in Q2, with trade-exemptions and domestic demand supporting stabilization.

2. 📉 Persistent inflation and fiscal stimulus expectations suggest the Bank of Canada is unlikely to cut interest rates further in 2025.

SPONSORED

Financial News Keeps You Poor. Here's Why.

The scandalous truth: Most market news is designed to inform you about what already happened, not help you profit from what's coming next.

When CNBC reports "Stock XYZ surges 287%"—you missed it.

What you actually need:

Tomorrow's IPO calendar (not yesterday's launches)

Crowdfunding deals opening this week (not closed rounds)

What real traders are positioning for (not TV talking heads)

Economic data that moves markets (before it's released)

The financial media industrial complex profits from keeping you one step behind.

Stocks & Income flips this backwards. We focus entirely on forward-looking intel that helps you get positioned before the crowd, not informed after the move.

Stop chasing trades that happened already.

Start prepping for the next one.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

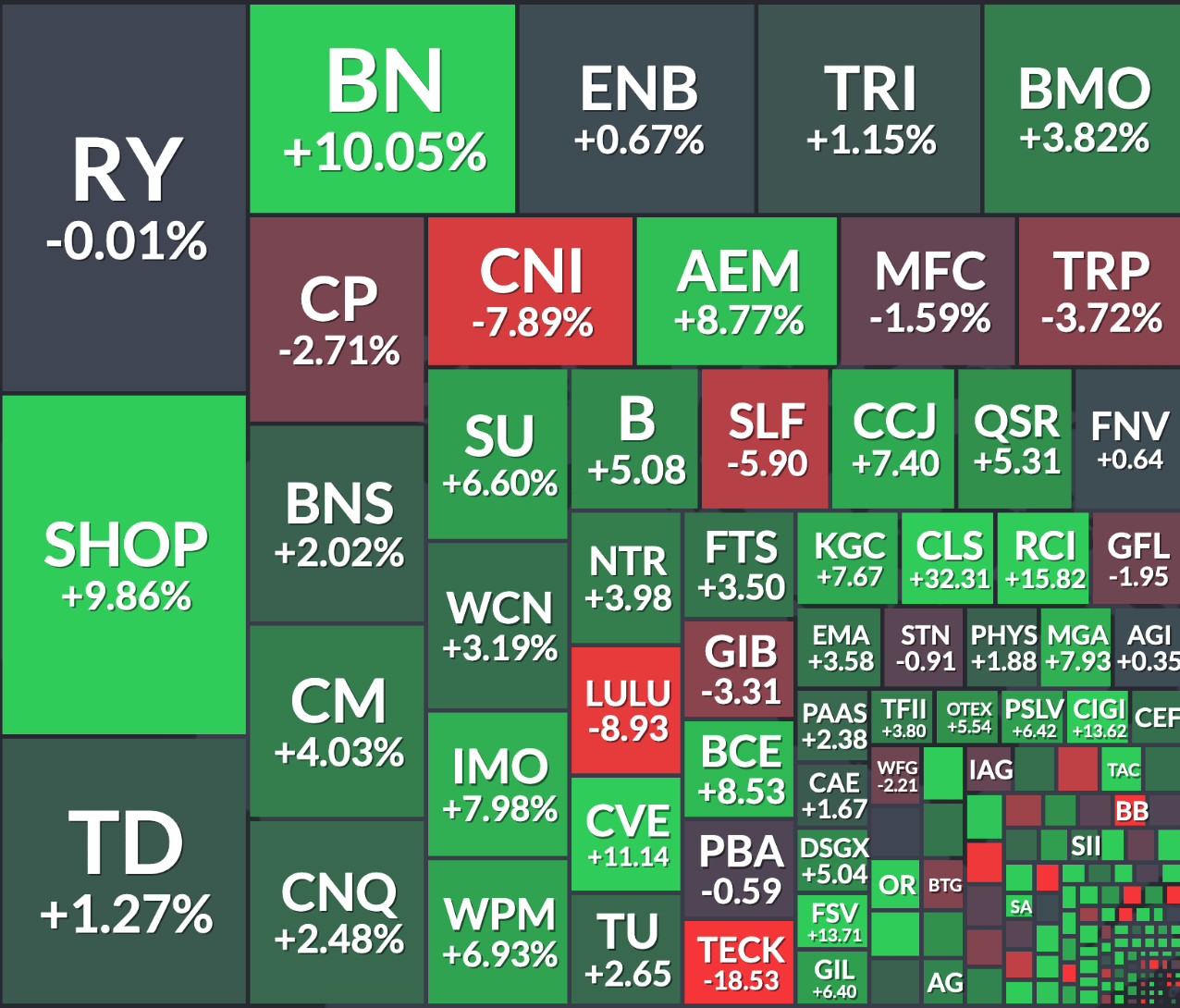

Canadian stocks over the last 30 days (end June - July 2025)

Markets rallied strongly in July, with the TSX surging across most sectors. Shopify, Brookfield, and CIBC led the charge, while energy names like CNQ and SU dragged slightly. Investor optimism seems to be holding, but underlying inflation and rate concerns linger. A cautiously bullish mood continues as we head deeper into Q3.

If you are looking for the best brokerage in Canada, we cannot reccomend Interactive Brokers highly enough. While others hide their fees in FX commissions, and give you access to just a few markets, Interactive Brokers has:

The lowest FX fees

150 markets across 33 countries

Trade U.S. stocks for as low as $0.005 per share

They cover all the Canadian account types you need, and have a experience for whatever your level (mobile trading, research and complex, or easy to use interface).

Popular articles on Wealth Awesome

Thats it for this month!

The Wealth Awesome Team

PS: Check out our new tools site!

SPONSORED

Start learning AI in 2025

Keeping up with AI is hard – we get it!

That’s why over 1M professionals read Superhuman AI to stay ahead.

Get daily AI news, tools, and tutorials

Learn new AI skills you can use at work in 3 mins a day

Become 10X more productive