Welcome to the October edition of the Wealth Awesome newsletter. Thank you to the 20,000+ 🇨🇦 subscribers who join us today!

Market Update

If you are looking for a great trading platform, check out CIBC Investors Edge today and get 100 free trades!

Summary

From Trade Fade to Q3 Upgrade: Canada’s Economy Gets a Second Wind

Canada’s economy regained its footing in Q3 2025, growing an estimated 0.5% after a trade-driven contraction in Q2.

While heavily trade-exposed industries like manufacturing and wholesale are only partially recovering from steep declines earlier in the year, domestic demand has stayed resilient, supported by steady consumer spending and rising residential investment.

Early September indicators—including a jump in manufacturing sales, rising oil production, and normalization in air transportation—point to a stronger finish to the quarter, though missing U.S. trade data may bring future revisions.

Overall, the economy is stabilizing, with signs of improving momentum heading into Q4.

⏱ TLDR: Despite the gloom and doom and talks of bubbles, the structural economic foundation looks good.

Key Takeaways 💡

1. Trade stabilizes, but domestic demand carries the load: Consumer spending and housing investment continue to offset lingering weakness in export-exposed sectors.

2. Momentum turning positive: Stronger September manufacturing, oil output, and transportation signal a firmer base for Q4 growth.

If you are looking for a great trading platform, check out Interactive Brokers today for some of the lowest commissions - and some of the highest interest paid on your cash balance.

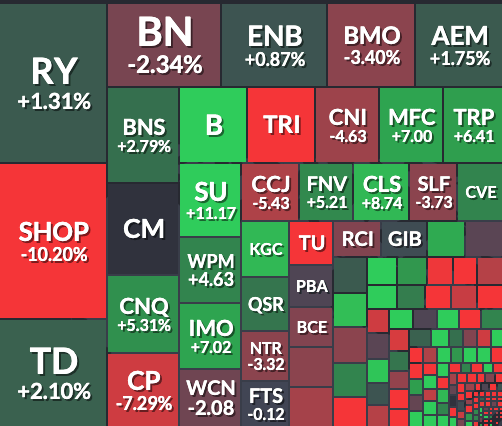

Canadian stocks over the last 30 days (end October - November 2025)

The TSX saw a mixed but generally positive month, with strength concentrated in financials, energy, and industrials while tech lagged sharply.

Standouts included SU (+11.17%), MFC (+7.00%), TRP (+6.41%), and CNQ (+5.31%), alongside solid gains in banks like TD (+2.10%) and BNS (+2.79%).

Materials also lifted the index, with names like FNV (+5.21%) and CLS (+8.74%) performing well.

The major drag came from Shopify (-10.20%) and other tech-adjacent names, as well as select telecom and utilities.

Overall, the market leaned green with energy and dividend-heavy sectors driving momentum despite pockets of notable weakness.

Popular articles on Wealth Awesome

Thats it for this month!

The Wealth Awesome Team