Welcome to the October edition of the Wealth Awesome newsletter. Thank you to the 20,000+ 🇨🇦 subscribers who join us today!

An espresso shot for your brain

The problem with most business news? It’s too long, too boring, and way too complicated.

Morning Brew fixes all three. In five minutes or less, you’ll catch up on the business, finance, and tech stories that actually matter—written with clarity and just enough humor to keep things interesting.

It’s quick. It’s free. And it’s how over 4 million professionals start their day. Signing up takes less than 15 seconds—and if you’d rather stick with dense, jargon-packed business news, you can always unsubscribe.

Market Update

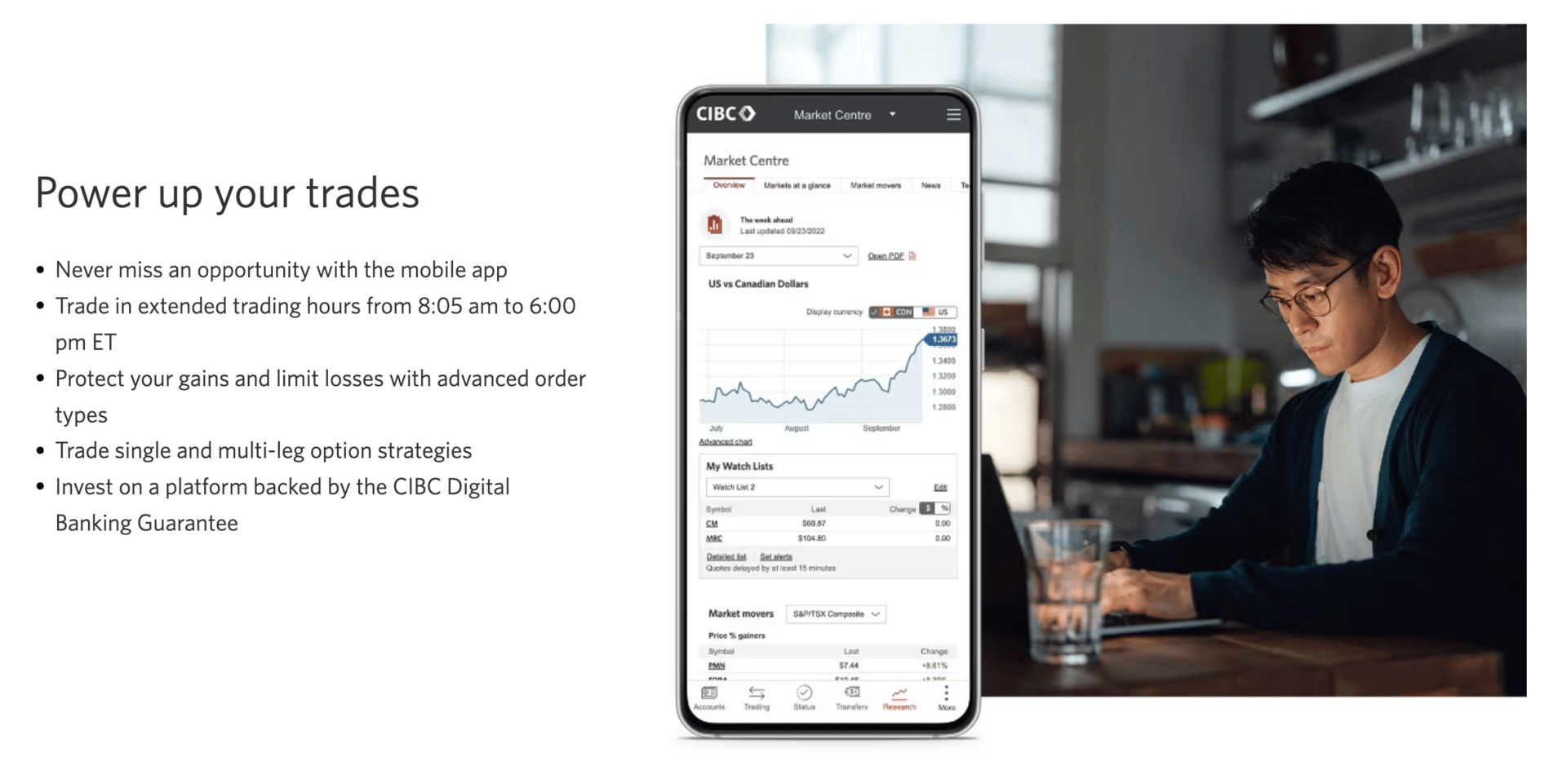

If you are looking for a great trading platform, check out CIBC Investors Edge today and get 100 free trades!

Summary

From Green to Grit: Energy’s Fall Turns the TSX Cautious

All eyes are on Canada’s September inflation and retail data as the Bank of Canada weighs another potential rate cut on October 29.

With headline CPI expected to rise to 2.3% and core inflation holding near 3%, policymakers are balancing progress toward their 2% target against signs of underlying price stickiness.

Business sentiment appears to be stabilizing, while consumer spending remains firm after a summer slowdown.

Despite a stronger September jobs report, RBC Economics expects another 25-basis-point cut this month as the central bank cautiously nudges policy toward supporting slower growth without reigniting inflation.

⏱ TLDR: BOC has a balancing act at the moment, but signs are pointing in the right direction.

Key Takeaways 💡

1. Data-driven decisions: Inflation remains above target, but steady consumer spending and softer retail trends keep a rate cut on the table.

2. Confidence returning: Business optimism and small business confidence are showing signs of recovery as trade tensions ease.

If you are looking for a great trading platform, check out Interactive Brokers today for some of the lowest commissions - and some of the highest interest paid on your cash balance.

Canadian stocks over the last 30 days (end September - October 2025)

Markets softened in October, with broad weakness across the TSX driven by energy and materials. Big names like Franco-Nevada (-10.02%), Suncor (-8.64%), Imperial Oil (-8.01%), and Canadian Natural Resources (-6.85%) dragged the index lower.

Financials were mixed—BN (-6.78%) and BMO (-3.34%) slipped, while TD (+1.36%) and CM (+0.49%) edged up modestly. Tech showed resilience, with Shopify (+3.51%) leading gains, and industrials like CNI (+3.24%) providing support.

Overall, the market painted a cautious picture—green pockets of strength offset by widespread red as investors remain wary of inflation and interest rate signals.

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Popular articles on Wealth Awesome

Thats it for this month!

The Wealth Awesome Team