Welcome to the August edition of the Wealth Awesome newsletter. Thank you to the 17,000+ 🇨🇦 subscribers who join us today!

Market Update

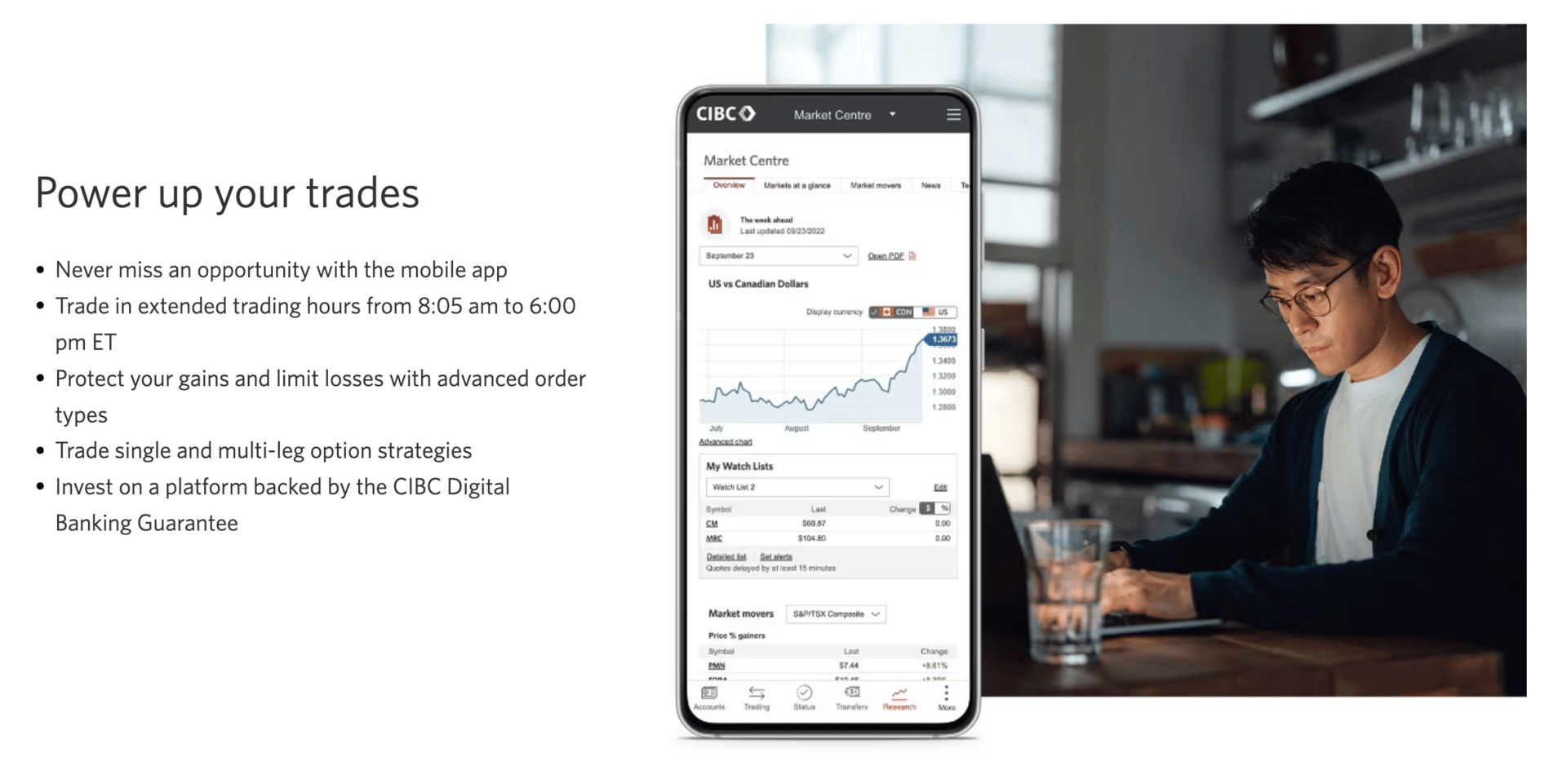

If you are looking for a great trading platform, check out CIBC Investors Edge today and get 100 free trades!

Summary

A Summer Sizzle: Housing, Oil, and Exports Lift Canada’s GDP

Canada’s economy showed early signs of recovery in July after a flat Q2, with GDP expected to rise 0.2%, surpassing StatsCan’s initial estimate.

Export and manufacturing volumes rebounded, oil output gained as Alberta recovered from wildfires, and housing resales climbed nearly 4%.

While employment fell sharply, hours worked held steady, and retail sales, though soft in July, are tracking a rebound in August.

The Bank of Canada remains cautious—further rate cuts depend heavily on upcoming trade, labour, and business sentiment data.

⏱ TLDR: Step by step, we are turning the cycle to the next phase.

Key Takeaways 💡

1. Momentum returns: Stronger exports, manufacturing, and housing helped offset earlier Q2 weakness.

2. Policy crossroads: Future BoC cuts hinge on softer data; July’s rebound leaves decisions finely balanced.

Ever heard of Koho?

Its like a bank account, a savings account and a rewards app - all in one. Free etrasnfers and cashback on purchases that you make every day (like groceries and gas)

Canadian stocks over the last 30 days (end August - September 2025)

The TSX posted a broadly positive month, with gains across most sectors led by big banks and energy. Standouts included BMO (+12.78%), RY (+8.11%), BN (+7.37%), and CNQ (+5.57%), while Shopify (+5.91%) and TD (+5.92%) also added solid strength.

Oil-linked names like IMO (+6.93%) and SU (+5.05%) contributed to the rally, and financials saw consistent upside. On the downside, Thomson Reuters (-10.74%) and WCN (-5.46%) weighed, alongside modest weakness in CNI (-2.92%). Overall, markets leaned green, showing resilience despite pockets of softness in select industrial and information names.

Popular articles on Wealth Awesome

Thats it for this month!

The Wealth Awesome Team